The initial public offering (IPO) of Blue Jet Healthcare opened today and will close on October 27, 2023. The company set the price band at ₹ 329 to ₹ 346 per equity share with a total lot size of 43 shares. The total IPO size is ₹ 840 crore, which is completely an offer for sale (OFS).

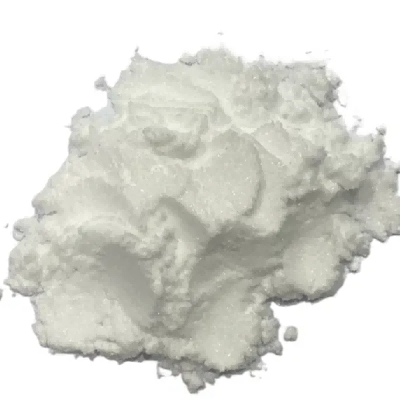

Blue Jet Healthcare IPO: GMP, subscription status, review, other details. Apply or not? 2-(2-Oxo-4-Phenylpyrrolidin-1-Yl)Acetohydrazide

Blue Jet Healthcare is a specialty pharmaceutical and healthcare ingredient and intermediate company, offering niche products targeted towards innovator pharmaceutical companies and multi-national generic pharmaceutical companies.

Established in 1968, the company has evolved its business model into a Contract Development and Manufacturing Organization (CDMO), featuring specialised chemistry expertise in contrast media intermediates and high-intensity sweeteners.

The company's operations are primarily categorised into these product segments: contrast media intermediates, high-intensity sweeteners, pharma intermediates, and active pharmaceutical ingredients (APIs). In FY22, the bulk of its revenue, approximately 70%, was generated from contrast media intermediates, with 23.27% coming from high-intensity sweeteners and 6.08% from pharma intermediates and APIs.

Furthermore, in terms of profit after tax (PAT), the company demonstrated improvement, with a net profit of ₹ 181.59 crore in FY22, representing an improvement from ₹ 135 crore in FY21 and ₹ 144 crore in FY20, according to the company's DRHP report.

Five Major Clients Driving Revenue

In FY22, the company generated ₹ 560 crore in revenue from 10 large customers, constituting a significant 84.06% of its total revenue. Among these top ten, the five large customers alone contributed ₹ 516 crore, amounting to approximately 76% of the total revenue.

Notably, among these, the single largest customer plays a pivotal role, contributing ₹ 425 crore in revenue and representing about 62.30% of the company's total revenue.

It supplies a critical starting intermediate and several advanced intermediates primarily to three of the largest contrast media manufacturers in the world, including GE Healthcare, Guerbet, and Bracco, directly. The four largest contrast media manufacturers in the world contributed to more than 70% of the global moving annual turnover consistently from April 2011 to March 2022.

As of March 31, 2022, the company offered high-intensity sweeteners to over 250 customers in India, United States, Europe, Asia, and Latin America, with a focus on marquee customers such as Colgate-Palmolive (India) Limited, Unilever, Prinova US LLC, and MMAG Co. Ltd., and many other international and domestic manufacturers across all end product categories, including oral care products, soft drinks, cosmetics, and pharmaceutical products.

The company markets its pharma intermediates and APIs in both regulated markets and emerging markets. As of March 31, 2022, it had over 35 customers in India and 50 globally across Europe, North America, South America, and Asia, as per the company's DRHP report.

“Although we have long-term contracts with such key customers, ranging from terms of one to five years with options for renewal, we may experience a reduction in the amount of business we obtain from our customers, which could be due to circumstances specific to them, such as pricing pressures, or adverse market conditions affecting our supply chain or the pharmaceutical industry, such as the COVID-19 pandemic," the company said.

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of Mint. We advise investors to check with certified experts before taking any investment decisions.

"Exciting news! Mint is now on WhatsApp Channels 🚀 Subscribe today by clicking the link and stay updated with the latest financial insights!" Click here!

Get the best recommendations on Stocks, Mutual Funds and more based on your Risk profile!

Download the Mint app and read premium stories

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

ks-0037 This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp